The Evolution of Digital Payments: Cryptocurrencies and Mobile Wallets

Traditional payment methods have evolved significantly with advancements in technology and changing consumer preferences. From bartering goods to using physical coins and bills, the methods of facilitating transactions have constantly adapted to meet the needs of a growing global economy. As societies transitioned from agrarian to industrial to digital eras, the way people exchange goods and services has undergone a series of transformations.

The introduction of banknotes, cheques, and electronic transfers revolutionized the way people conduct transactions, making payments more convenient and secure. As economies became more interconnected, the need for efficient payment systems became increasingly vital. The evolution of traditional payment methods has not only facilitated commerce but has also played a key role in shaping the financial landscape we see today.

The Rise of Cryptocurrencies

Bitcoin, the first cryptocurrency, was introduced in 2009 by an unknown person or group of people under the pseudonym Satoshi Nakamoto. Since then, the world of digital currencies has rapidly expanded, with thousands of cryptocurrencies now available in the market. Cryptocurrencies operate on a decentralized network called blockchain, which ensures transparency and security in transactions.

One of the key drivers behind the popularity of cryptocurrencies is the potential for users to make transactions anonymously. This level of privacy is highly appealing to individuals who value their financial autonomy and wish to conduct transactions without the oversight of banks or other financial institutions. Additionally, cryptocurrencies have lower transaction fees compared to traditional payment methods, making them a cost-effective alternative for global transactions.

Advantages of Using Mobile Wallets

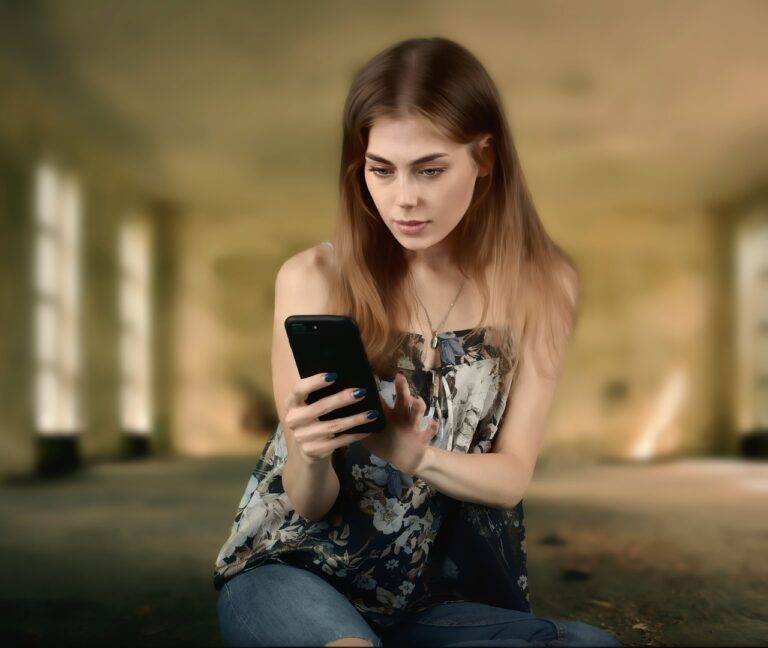

Mobile wallets offer a convenient and secure way to make transactions without the need to carry physical cash or credit cards. With just a few taps on your smartphone, you can easily make payments for purchases, bills, or even split bills with friends. This eliminates the hassle of fumbling through your wallet or purse to find the right cards or exact change.

Another advantage of using mobile wallets is the added layer of security they provide. Most mobile wallet apps use encryption and tokenization technology to protect your payment information, making it more secure than using a physical card. Additionally, many mobile wallets also offer features like fingerprint or facial recognition authentication, adding an extra level of security to your transactions.